The VERIANOS group

VERIANOS SE is a listed real estate investment and advisory firm and holding of the VERIANOS group. Shares are mainly traded at the open market segment of the Frankfurt stock exchange. Shares are also traded at the stock exchanges of Berlin, Stuttgart and Düsseldorf.

Company profile

VERIANOS SE is a listed investment and advisory company solely focused on real estate as an asset class. The primary listing of the share is at the Basic Board segment of the Frankfurt Stock Exchange (FWB). Secondary listings are at the stock exchanges of Berlin, Stuttgart and Dusseldorf.

VERIANOS provides services for a broad range of clients, in particular institutional investors, family offices, fund management companies, financial institutions and property companies, with its two business units Investment and Advisory.

With the business unit Investment VERIANOS acts as a principal investor or with joint venture and co-investment structures to acquire properties and property-backed assets and create value in complex situations. As an investment manager, VERIANOS sources, structures and executes single asset and portfolio transactions. A BaFin-registered capital management company, as a wholly owned subsidiary, develops and launches Alternative Investment Funds (AIFs) that it places with clients.

The VERIANOS Advisory unit offers focused financial and consultancy services for selected clients. As a placement agent the firm supports fund management companies in the placement of investment products and raises equity and debt capital from institutional investors, banks and family offices. In addition, VERIANOS analyses, prepares, structures and executes real estate M&A transactions and develops individual and holistic property strategies at asset, portfolio and company levels.

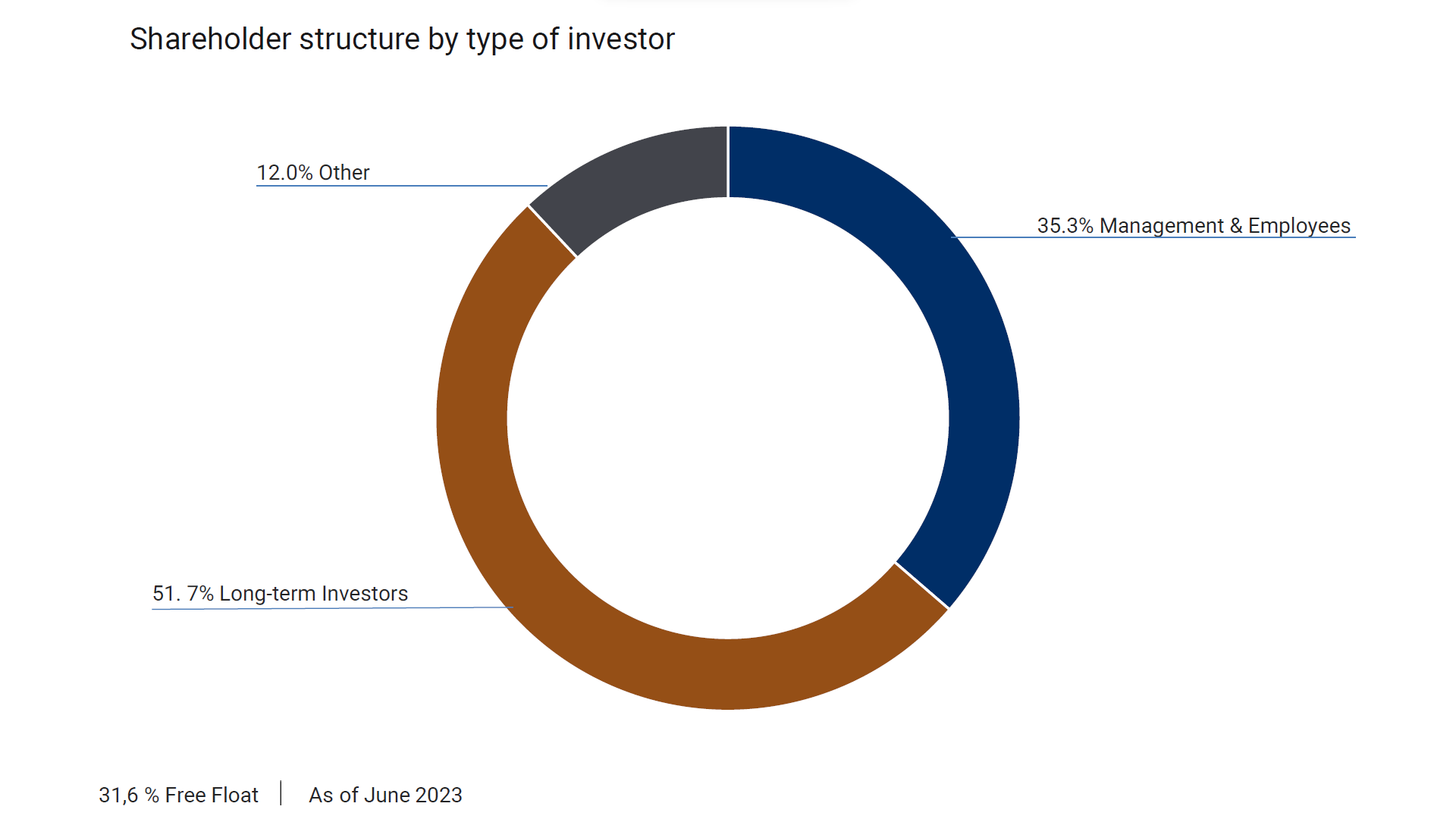

VERIANOS is an independent company, mainly owned by its staff and private shareholders with a long-term approach.

| Company | VERIANOS SE |

|---|---|

| Founding date | 08.02.2011* |

| Accounting standard | The annual financial statements are prepared in accordance with the regulations of the German Commercial Code (HGB) and stock corporation law. The management report complies with the new German accounting standard DRS 20 |

| End of financial year | 31.12. |

| Executive directors | Tobias Bodamer, Michael Hoffmann |

| Administrative board members | Tobias Bodamer (Chairman), Karl-Josef Schneiders (Vice Chairman), Dott. Giulio Beretti, Dott. Piero Munari |

| ISIN | DE000A0Z2Y48 |

| Ticker symbol | VROS |

| Specialist | Baader Bank AG |

| Paying agent | Bankhaus Gebr. Martin |

| Designated Sponsor | Pareto Securities AS |

*Original founding date of the predecessor company Real² Immobilien AG: 12.11.1991

The share

| Total number of shares | 13.750.000 |

| Amount of nominal capital | EUR 13.750.000 |

Klicken Sie auf den unteren Button, um den Inhalt von bfrank.ariva-services.de zu laden.

Key figures

| in thousand EUR | 2022 | 2021 |

|---|---|---|

| ASSETS AND CAPITAL STRUCTURE | ||

| Long term capital | 19,461 | 18,611 |

| Short term capital | 15,344 | 13,008 |

| Equity | 5,902 | 9,456 |

| Equity ratio (%) | 17.0% | 29.91% |

| Long term liabilities | 27,340 | 20,470 |

| Short term liabilities | 1,563 | 1,693 |

| Balance sheet total | 34,805 | 31,619 |

Turnover and income

| TURNOVER AND INCOME | 2022 | 2021 |

|---|---|---|

| Turnover | 1,774 | 1,730 |

| Total output | 2,726 | 3,119 |

| EBITDA | -2,521 | -2.024 |

| Consolidated net loss | -3,554 | -3.004 |

Corporate bond 2022 / 25

VERIANOS SE issues a new secured corporate bond (ISIN: DE000A30VG50) with an issue volume of up to EUR 25 million and a coupon of 8.0% as part of a private placement to selected investors. Click here for the press release: Corporate bond 2022 / 25

Notification of security ratio as of balance sheet date 31.12.2022: Security ratio 2022

The bond is listed on the Frankfurt Stock Exchange in the Open Market Segment Quotation Board.

Corporate bond 2020 / 25

VERIANOS SE issues a new corporate bond with an issue volume of up to EUR 30 million and a coupon of 6.00 % as part of a private placement to selected investors. If you are interested, please contact the issuing bank BankM AG. Click here for the press release: Corporate bond 2020 / 25

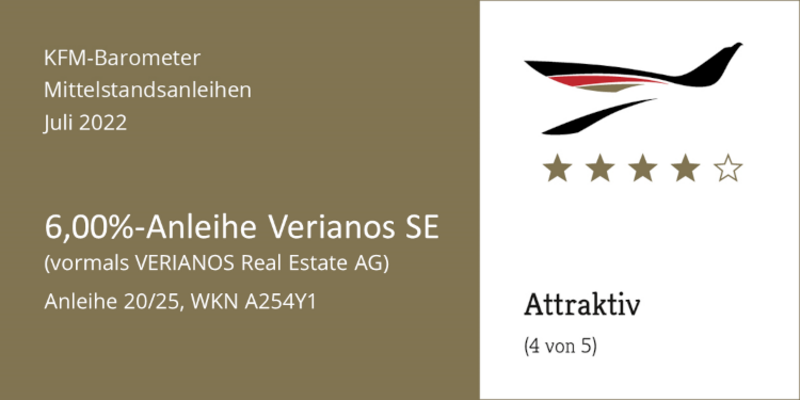

Independent Rating

In its recent Mittelstandsanleihen-Barometer report, KFM Deutsche Mittelstand AG rates the 6.00% VERIANOS corporate bond (WKN: A254Y1) to “attractive“ with 4 out of 5 possible scoring points.

KFM Deutsche Mittelstand AG is an expert for small and mid-cap corporate bonds and initiator of the Deutscher Mittelstandsanleihen FONDS (WKN A1W5T2, German small and mid-cap corporate bond fund).

Corporate bond 2018 / 23

Corporate bond for professional and semiprofessional investors

The 6.5% Corporate Bond 2018 / 23 by VERIANOS SE is an investment into a fixed coupon security. The capital raised with this bond will be used for entrepreneurial investment into residential property.

Corporate bond for professional and semiprofessional investors

The 6.5% Corporate Bond 2018 / 23 by VERIANOS is an investment into a fixed coupon security. The capital raised with this bond will be used for entrepreneurial investment into residential property.

Listing

The bond will be listed at the Frankfurt Stock Exchange (Frankfurter Wertpapierbörse, FWB) at the Open Market in the Quotation Board segment. The debt instruments are subject to the terms & conditions of Deutsche Börse AG and the EU Regulation on Market Abuse (MAR). The bonds can be traded at the Frankfurt exchange and through FWB’s electronic XETRA platform.

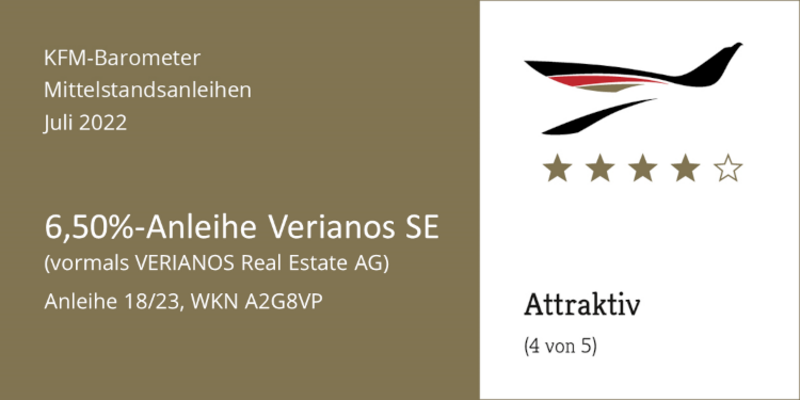

Independent Rating

In its recent Mittelstandsanleihen-Barometer report, KFM Deutsche Mittelstand AG continues to rate the 6.50% VERIANOS corporate bond (ISIN: DE000A2G8VP3) as “attractive“ with 4 out of 5 possible scoring points.

KFM Deutsche Mittelstand AG is an expert for small and mid-cap corporate bonds and initiator of the Deutscher Mittelstandsanleihen FONDS (WKN A1W5T2, German small and mid-cap corporate bond fund).

Financial reports

Here you will find our financial reports for download in the PDF format. Printed copies of the annual reports are available on request. As part of our sustainability approach we refrain from producing printed copies of the half year reports.

Financial reports 2023

Financial reports 2022

Financial reports 2021

Financial reports 2020

Financial reports 2019

Financial reports 2018

Financial reports 2017

Financial reports 2016

Financial reports 2015

Financial calendar

| Until 31 July 2024 | Publication of Annual Report 2023 |

| 19 September 2024 | Virtual Annual General Meeting |

| Until 31 October 2024 | Publication of Interim Consolidated Report 2024 |

Annual General Meeting

Voting results for the Annual General Meeting 2023 (PDF)

Invitation Annual General Meeting 2023 / Agenda (PDF)

Compliance

VERIANOS SE takes compliance seriously. The board unconditionally commits itself to compliance and has developed a comprehensive compliance management system ensuring that all activities of VERIANOS are always in accordance with legal rules as well as internal guidelines and regulations. At the same time responsible thinking and acting of staff are promoted and encouraged. The compliance management system is based on two pillars: prevention as well as investigation and reaction.

Preventive measures are particularly regular training of all staff and a detailed compliance guideline which binds the board and all staff regardless of their position in the company hierarchy. The guideline details legal rules, defines internal standards of conduct and serves as an orientation for critical situations. It is intended to protect staff from violations of statutory rules and contractual obligations, to avoid conflicts between business and private interests and to protect the company from financial and reputational damage.

Contact Investor Relations

VERIANOS SE

Investor Relations

Gürzenichstraße 21

50667 Cologne

Germany

T +49 221 20046-100

F +49 221 20046-140

ir@verianos.com

www.verianos.com